Bankers, Terrorists, and Politicians: Saudi Arabia, bin Ladin, Prince Alwaleed Bin Talal, 9/11, the Rothschilds, Citi Bank, and Deutsche Bank

Shortly before the terrorist attacks on September 11th, 2001, Deutsche Bank took a short position involving 2,000 shares of UAL, the parent company of United Airlines (one of their planes hit the WTC, the other was crashed in Pennsylvania by passengers).

CNN published a story on September 24th, 2001, sharing details of suspicious short-sells on the stock market in various countries right before the terrorist attacks on 9/11:

“Germany’s central bank governor, Ernst Welteke, says there were signs of suspicious movements in oil and gold prices before the attack. Investigators in Europe are also looking at trading in insurance and airline stocks.

There are strong suspicions that British markets may have been used for transactions, says Belgian Finance Minister Didier Reynders. Sources in London say no evidence has turned up yet, although an investigation at all exchanges is being conducted….

In New York, investigators are looking into the possibility that terrorists might have used short-selling to bet against the stocks of the very airlines they planned to hijack.

Short-selling can yield big profits when stocks go down in value. Those who practice it sell borrowed stock at today’s price, hoping to buy it back tomorrow at a lower price — pocketing the difference as a profit.

Here’s how it works: The stock of UAL Corporation — United’s parent — has plunged from over $30 a share on September 10 to just over $17 at last Friday’s close. A person who sold short 1,000 shares of UAL then, and closed out the trade Friday, would have made a profit of $13,720, minus broker’s commissions.

Late last week, the New York Stock Exchange reported that the parent companies of both American Airlines and United Airlines experienced sharp increases in short-selling of their stocks in the month that ended the day before the attacks.

Between August 10 and September 10, the NYSE says short sales of UAL Corp. increased 40 percent, American parent AMR Corp increased 20 percent, and aircraft manufacturer Boeing Corp. increased 37 percent.

Short-sellers with advance knowledge of the attack could have made millions.

None of this proves anything. Big increases in short-selling happen all the time. And airlines were in financial trouble even before the attacks, which many speculators may have seen as good financial reason to short their stock.

But federal investigators have said publicly they are looking at reports that the terrorists may have tried to profit from exploiting securities markets.”

Foreign Policy Journal wrote a story entitled RE: Deutsche Bank, Alex Brown, and 9/11 Inside Trading, which shared the following:

Erik Kirschbaum from the news agency Reuters reported in December 2001 that Convar had at that time successfully restored information from 32 computers, supporting ‘suspicions that some of the 911 transactions were illegal.’

‘The suspicion is that inside information about the attack was used to send financial transaction commands and authorizations in the belief that amid all the chaos the criminals would have, at the very least, a good head start,’ says Convar director Peter Henschel.’ Convar received the costly orders – according to Kirschbaum´s report the companies had to pay between $20,000 and $30,000 per rescued computer – in particular from credit card companies, because: ‘There was a sharp rise in credit card transactions moving through some computer systems at the WTC shortly before the planes hit the twin towers. This could be a criminal enterprise – in which case, did they get advance warning? Or was it only a coincidence that more than $100 million was rushed through the computers as the disaster unfolded?‘

Wagner’s observation that there had been “illegal financial transactions shortly before and during the WTC disaster” matches an observation which Ruppert describes in Crossing the Rubicon. Ruppert was contacted by an employee of Deutsche Bank, who survived the WTC disaster by leaving the scene when the second aircraft had hit its target. According to the employee, about five minutes before the attack the entire Deutsche Bank computer system had been taken over by something external that no one in the office recognized and every file was downloaded at lightning speed to an unknown location. The employee, afraid for his life, lost many of his friends on September 11, and he was well aware of the role which the Deutsche Bank subsidiary Alex Brown had played in insider trading.

Max Keiser: There are many aspects concerning these option purchases that have not been disclosed yet. I also worked at Alex Brown & Sons (ABS). Deutsche Bank bought Alex Brown & Sons in 1999. When the attacks occurred, ABS was owned by Deutsche Bank. An important person at ABS was Buzzy Krongard. I have met him several times at the offices in Baltimore. Krongard had transferred to become executive director at the CIA.…

Under consideration here is the fact that Alex Brown, a subsidiary of Deutsche Bank (where many of the alleged 9/11 hijackers handled their banking transactions – for example Mohammed Atta) traded massive put options purchases on United Airlines Company UAL through the Chicago Board Option Exchange (CBOE) – ‘to the embarrassment of investigators,’ as British newspaper The Independent reported.

On September 12, the chairman of the board of Deutsche Bank Alex Brown, Mayo A Shattuck III, suddenly and quietly renounced his post, although he still had a three-year contract with an annual salary of several million US dollars. One could perceive that as somehow strange.

Osama bin Laden’s family maintained bank accounts at Deutsche Bank. Several al-Qaeda members utilized Citigroup, which managed transaction sent from the UAE to 9/11 hijackers in the United States.

From their arrival in Sudan in 1991 to their expulsion and hasty retreat to Afghanistan in 1996, Bin Laden and his followers built up an intricate financial network based on Islamic practices, and dozens of “charities” raising money for jihad from the rich and faithful around the Gulf. US investigators believe Ahmad was instrumental in the building of the empire. The financial links between the Bin Laden organisation and suspected terrorist cells in Germany are also beginning to emerge. At the weekend, a spokesman for Deutsche Bank said it had provided investigators with information on accounts linked to members of Osama bin Laden’s family.

According to the news weekly, Der Spiegel, Deutsche Bank, Germany’s largest commercial bank, handled accounts for the Bin Laden family worth DM 314m (£103m). German law generally prohibits the publication of data about bank clients, but Deutsche Bank gave authorities a list of less than 10 accounts it suspected were linked to terrorists or terrorist activities days after the September 11 attacks on New York and Washington. Among those listed were accounts held by the Bin Laden family, Spiegel reported.

According to the economics ministry in Berlin, 13 accounts in Germany have been blocked since the start of the financial clampdown on Bin Laden’s terrorist network last week. The accounts had an overall balance of DM 2.7m (£900,000).

Central Banks and Terrorists

Terrorists involve in the 9/11 terrorists attacked used the Saudi Arabia British Bank and Citigroup:

The hijackers also financed their activities in the United States by accessing funds deposited into overseas accounts. There are two primary examples of this method. Hani Hanjour maintained accounts at the Saudi British Bank in Saudi Arabia and at Citibank in the UAE. While in the United States, he accessed his foreign accounts through an ATM card to finance his activities. Approximately $9,600 was deposited into the Saudi British Bank account, and $8,000 into the Citibank account. Ali said he provided Hanjour with $3,000 to open the Citibank account and deposited another $5,000 into that account while Hanjour was in the United States…

Ali wire transferred a total of $114,500 to the plot leaders Shehhi and Atta after their arrival in the United States. Ali did not return to the Wall Street Exchange Centre. Instead, using a variety of aliases, he sent the money from the UAE Exchange Centre in Dubai, where no identification was required… All of the bank-to-bank transactions flowed through the UAE Exchange’s correspondent account at Citibank.

As well as Deutsche Bank:

Saudi Arabian Prince Saudi Prince Alwaleed bin Talal became the largest shareholder in Citigroup in 1991. As of 2017, bin Talal owns a 4.9% stake in Citigroup. bin Talal’s investment history with Citigroup according to Morningstar:

However, the bank had a precarious balance sheet, with a few billion of loan-loss reserves mainly on Third World debt. They were being criticised for their real estate assets and on the capital front. The bank desperately needed capital as the Federal Reserve urged it to strengthen its capital base after it lost significant sums on property loans. Citi’s hunt for investors (it needed $1–1.5 billion) was failing and its stock price kept sliding downwards. Moody’s had downgraded Citi preferred stock to a speculative “junk” rating and many began to wonder if the bank would fold up. At the end of 1990, Prince Alwaleed quietly bought 4.9% of Citicorp’s existing common shares for $207 million ($12.46 per share) on the open market. Once the management noticed him and approached him for further investments, he played his cards shrewdly. In February 1991, he bought new preferred shares, amounting to $590 million, amounting to a further 10% of Citicorp and taking his stake to 14.9%. These preferred shares were convertible into common shares at $16 each. In addition to an 11% dividend on the new issue of convertible preferred stock, he would earn a profit if the common stock rose above $16 a share.

Early March, Citicorp’s capital crisis passed when a group of investors bought a further $600 million of new preferred shares. By 1994, Tier I capital had increased to 6.1%, above the 6% threshold for a well-capitalized bank set by the government. The stock price began to climb. Dividend payments resumed. Citi came back from the precipice and had recovered from its crisis. In 1998, Citicorp merged with Travelers Group to create Citigroup. Prince Alwaleed made insane amounts of money on his contrarian bet…

He was the architect of Saudi Arabia’s first hostile takeover. In 1988, he acquired a controlling stake in United Saudi Commercial Bank. The ailing bank turned around (cut in staff, increase in assets) and the value of the bank’s stock subsequently multiplied 20-fold. In an interview, he pointed to the fact that under his helm the bank became the first in Saudi Arabia in terms of return on assets (ROA) and the second in terms of return on equity (ROE). Within a decade, it merged with the struggling Saudi Cairo Bank, thus creating the United Saudi Bank, which again merged with Saudi American Bank, as it is now known.

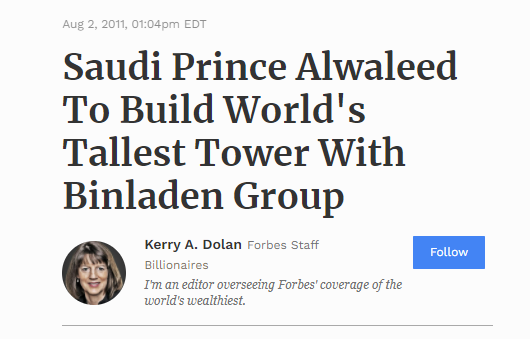

al Qaeda operative Zacarias Moussaoui, who was supposed to be the 20th hijacker during the 9/11 attacks, accused Prince Alwaleed bin Talal with financing the attack. In November 2017, bin Talal was detained by Saudi Crown prince bin Salman. In the month prior, Saudi officials detained the head of Binladin Group, a major international construction company that completed an array $100 million+ buildings in Saudi Arabia other countries. The Binladin Group was created by Osama bin Laden and continued to be managed by his family until Saudi Arabia took control of the company in January 2018.

Citigroup, while still known as the City Bank of New York, was the first contributor to the United States Federal Reserve system in 1913. In 2018, Citi held the largest share of the New York Federal Reserve, holding 42.8% of all shares.

Osama Bin Laden

Bin Laden was killed by members of SEAL Team 6 at his Abbottabad compound in Pakistan in 2011. Following his death, the BinLadin group received an offer by Rothschild to manage debts, a contract ultimately awarded to a $15 million bailout by Rothschild in 2019. Binladen Group ultimately awarded the bid to Houlihan Lokey Inc. in April 2020.

Ekpedeme Bassey, a board member for Houlihan Lockey Board, is an executive at Kraft Heinz. John Kerry is married to the widow of John Heinz, the great-grandson of the founder of Heinz.

Prince Alwaleed and the Binladin Group have partnered in several projects:

Prince Alwaleed bin Talal

Saudi Arabian Prince Alwaleed Bin Talal’s owns 95% of Kingdom Holding Company, which in-turn invested in Twitter. It is unclear what Alwaleed Bin Talal’s stake in Twitter is. He invested in Twitter in 2011. Twitter’s IPO took place in 2013. As of October 7, 2015, Kingdom Holding Company was Twitter’s second-largest shareholder.

In 2015, Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud owned a larger stake (5.2%) of Twitter than Jack Dorsey (3.2%). Back in November 2017, Alwaleed was detained and investigated for money laundering, which caused Twitter shares to drop by 0.6%, which demonstrates how dependent Twitter’s future outlook is on Alwaleed Bin Talal. The scandal impacted stock shares for companies Kingdom Holding Company was vested in, including Apple.

Kingdom Holding Company has owns a significant stake in Citibank. In 2018, Citibank was the largest stockholder in the New York Federal Reserve and “held 87.9 million New York Federal Reserve Bank shares – or 42.8 percent of the total.” Citibank has faced finances and regulatory issues this year from the Federal Reserve and was also a major recipient of the 2007-2009 bank bailouts.

Forbes wrote an extensive story on Prince Alwaleed Bin Talal and Kingdom Holding Company. The piece was considered a story of the decade and covers Alwaleed’s personal life, business partners, upbringing, and investments.

Citigroup received $476 billion in bailout funds following the banking crisis caused by credit default swaps and a massive mortgage crash in 2007 and 2008.The Federal Reserve provided special benefits to help Citibank avoid having his credit ranking lowered by the FDIC and was placed on a “big too to fail” list. The Federal Reserve also allowed Citibank to offset overdrafts:

“Now the problem, the New York Fed bank examiner told colleagues, was that another regulator, the Federal Deposit Insurance Corporation, planned to lower a critical rating it held on the precarious financial health of Citibank, the main banking subsidiary of Citigroup.

Lowering the rating, then-FDIC Chair Sheila Bair wrote in her 2012 book Bull by the Horns, would have delivered a gunshot to Citibank by putting it on the FDIC’s very public list of problem bank assets. (While the list does not name banks, assets as large as Citibank’s would have been easily identifiable.)

It would also have done something else previously unreported, former New York Fed sources tell Newsweek. It would have forced the New York Fed to restrict Citi’s ability to take part in the routine money shuffle banks need for basic operations: temporarily overdrawing their Federal Reserve accounts each day by hundreds of billions of dollars as payments from around the globe clear at different hours, then topping off the accounts by day’s end.

Amid the biggest financial crisis since the Great Depression, not being able to participate in that money shuffle, known as “daylight overdraft credit,” would have sent Citibank scrambling to the Fed’s beggar’s window, a facility known as the “discount window.” Even in ordinary times, banks don’t like using that alternative because it signals to investors and trading partners that a bank is in trouble. In a crisis, it can easily send a troubled bank’s investors, shareholders and trading partners running.

Citibank, long a bellwether stock, never showed up on the FDIC’s “problem bank assets” list—on May 26, 2009, Bair wrote, she got a call from Bernanke “asking that the FDIC not downgrade.” But downgrade or not, Citigroup had a liquidity problem on the horizon, and the quality of their assets was questionable, according to the two former New York Fed sources. So in mid-2009, these two sources say, the New York Fed quietly made an unusual, previously unreported deal with Citigroup.

The New York Fed would allow Citibank to continue to overdraw that all-important “daylight overdraft” account, although at reduced levels. In a companion, also atypical move, the New York Fed forced Citigroup to park some $30 billion in collateral, consisting of Treasury bills and soured derivatives whose value Fed officials discounted, in a Federal Reserve account as insurance that the bank would eventually square things in its overdraft account. The move was risky, one of the Fed sources adds: “If word got out on this, Citibank’s counterparties might flee, squeezing the entity further with liquidity pressure.”

Other Kingdom Holding Company Investments:

As of November 6th, 2017, KHC had investments in the following companies:

- Twitter (4.9%)

- Apple (5%)

- Lyft (5.3%)

- 21st Century Fox (4.98%)

Kingdom Holding Company invested $225 in Lyft in June 2019 (there was a recent referendum in California that applied to rideshare drivers) and a $250 million investment in Snap Inc. (Snapchat app) in August 2018.

Clinton Foundation Donors

The Clinton Foundation, a non-profit ran by former President Bill Clinton and his wife, Hillary, accepted between $10 and $25 million in donations from the Kingdom of Saudi Arabia (and the eugenic and focused and Nazi funding Rockefeller Foundation).

The Clinton Foundation also accepted between $5 and $10 million from Sheikh Mohammed H. Al-Amoudi, who was arrested during within the same time period as Prince Alwaleed bin Talal for corruption.

The Clinton Foundation also received between $500,000 and $1 million from Citigroup, where Alwaleed bin Talal is a major shareholder. Other donors include:

$1 million-$5 million

- Dubai Foundation (international bank in UAE)

- Exxon Mobile

- Clinton-Bush Haiti Fund

- Friends of Saudi Arabia

- Citi Foundation

- Nasser Al-Rashid (Saudi billionaire)

$500,000-$1 million

- Abraaj Holdings (fined a record $315 in 2019 for mismanaging client funds and misleading investors)

- Leon Black Foundation (Leon Black paid $158 million to Jeffrey Epstein)

- Itaú Unibanco S/A (raided in Dec. 2016 by Brazilian officials investigating the company bribing tax officials)

- Nike (linked to using forced labor by Uyghur prisoners)

- George Soros

$250,000-$500,000

- Prince Turki Al Faisal Al Saud

- Farhad Azima (Iranian-American airline executive. Lost civil case for $4.2 million for defrauding investors. Raised money for Bill Clinton).

- Deutsche Bank AG

- Deutsche Bank Americas

- Yongping Duan (Chinese billionaire and BBK Electronics)

- Qatar 2020 Supreme Committee (Qatar’s committee for the FIFA World Cup. Qatar was accused of bribing the committee to decide the 2022 FIFA World Cup host).

- Imaad Zuberi (sold access to high ranking American officials. Rubbed elbows with Clinton, Biden, Trump, Hillary, and Hollywood celebrities).

$100,000-$250,000

- Alwaleed Bin Talal Foundation

- Lynn F. de Rothschild (in Jeffrey Epstein’s private flight logs)

- A. Huda Farouki (charged by the Department of Justice in 2018 “for a scheme to defraud U.S. Military contracts in Afghanistan, engaging in illegal commerce in Iran, and laundering money internationally.Their conduct was in connection to two multi-million dollar contracts to provide supplies and logistical support to U.S. troops in Afghanistan.”)

- JP Morgan Chase (one of five banks accused of allowing terrorists to use their institution to transfer and hold money).

- Lockheed Martin (weapons manufacturing company mired in bribery scandals and levied with millions of dollars of fines)

- Harvey Weinstein (serial rapist and abuser with at least 87 victims)

Former President Barak Obama allowed United States agencies to provide hundreds of thousands of dollars to an affiliate of al-Qaeda (the terror group linked to Osama bin Laden):

Overall, the transition of funding from politicians, international bankers, and terrorists is concerning.