Saudi Prince and Russian Government Funded Facebook and Twitter

Like most tech giants, Twitter has relied on outside investors. Saudi Arabian Prince Alwaleed Bin Talal’s owns 95% of Kingdom Holding Company, which in turn invested in Twitter. It is unclear what Alwaleed Bin Talal’s stake in Twitter is. He invested in Twitter in 2011. Twitter’s IPO took place in 2013. As of October 7, 2015, Kingdom Holding Company was Twitter’s second-largest shareholder.

In 2015, Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud owned a larger stake (5.2%) of Twitter than Jack Dorsey (3.2%). Back in November 2017, Alwaleed was detained and investigated for money laundering, which caused Twitter shares to drop by 0.6%, which demonstrates how dependent Twitter’s future outlook is on Alwaleed Bin Talal. The scandal impacted stock shares for companies Kingdom Holding Company was vested in, including Apple.

Kingdom Holding Company has owns a significant stake in Citibank. In 2018, Citibank was the largest stockholder in the New York Federal Reserve and “held 87.9 million New York Federal Reserve Bank shares – or 42.8 percent of the total.” Citibank has faced finances and regulatory issues this year from the Federal Reserve and was also a major recipient of the 2007-2009 bank bailouts.

Forbes wrote an extensive story on Prince Alwaleed Bin Talal and Kingdom Holding Company. The piece was considered a story of the decade and covers Alwaleed’s personal life, business partners, upbringing, and investments.

Citigroup received $476 billion in bailout funds following the banking crisis caused by credit default swaps and a massive mortgage crash in 2007 and 2008. The Federal Reserve provided special benefits to help Citibank avoid having his credit ranking lowered by the FDIC and was placed on a “big too to fail” list. The Federal Reserve also allowed Citibank to offset overdrafts:

“Now the problem, the New York Fed bank examiner told colleagues, was that another regulator, the Federal Deposit Insurance Corporation, planned to lower a critical rating it held on the precarious financial health of Citibank, the main banking subsidiary of Citigroup.

Lowering the rating, then-FDIC Chair Sheila Bair wrote in her 2012 book Bull by the Horns, would have delivered a gunshot to Citibank by putting it on the FDIC’s very public list of problem bank assets. (While the list does not name banks, assets as large as Citibank’s would have been easily identifiable.)

It would also have done something else previously unreported, former New York Fed sources tell Newsweek. It would have forced the New York Fed to restrict Citi’s ability to take part in the routine money shuffle banks need for basic operations: temporarily overdrawing their Federal Reserve accounts each day by hundreds of billions of dollars as payments from around the globe clear at different hours, then topping off the accounts by day’s end.

Amid the biggest financial crisis since the Great Depression, not being able to participate in that money shuffle, known as “daylight overdraft credit,” would have sent Citibank scrambling to the Fed’s beggar’s window, a facility known as the “discount window.” Even in ordinary times, banks don’t like using that alternative because it signals to investors and trading partners that a bank is in trouble. In a crisis, it can easily send a troubled bank’s investors, shareholders and trading partners running.

Citibank, long a bellwether stock, never showed up on the FDIC’s “problem bank assets” list—on May 26, 2009, Bair wrote, she got a call from Bernanke “asking that the FDIC not downgrade.” But downgrade or not, Citigroup had a liquidity problem on the horizon, and the quality of their assets was questionable, according to the two former New York Fed sources. So in mid-2009, these two sources say, the New York Fed quietly made an unusual, previously unreported deal with Citigroup.

The New York Fed would allow Citibank to continue to overdraw that all-important “daylight overdraft” account, although at reduced levels. In a companion, also atypical move, the New York Fed forced Citigroup to park some $30 billion in collateral, consisting of Treasury bills and soured derivatives whose value Fed officials discounted, in a Federal Reserve account as insurance that the bank would eventually square things in its overdraft account. The move was risky, one of the Fed sources adds: “If word got out on this, Citibank’s counterparties might flee, squeezing the entity further with liquidity pressure.”

Other Kingdom Holding Company Investments:

As of November 6th, 2017, KHC had investments in the following companies:

- Twitter (4.9%)

- Apple (5%)

- Lyft (5.3%)

- 21st Century Fox (4.98%)

Kingdom Holding Company invested $225 in Lyft in June 2019 (there was a recent referendum in California that applied to rideshare drivers) and a $250 million investment in Snap Inc. (Snapchat app) in August 2018.

Russia, DST, Twitter, and Facebook

On November 5th, 20187, The New York Times ran an article outlining how the Russian government used an investment firm (DST Global) to invest in Twitter and Facebook:

“In the fall of 2010, the Russian billionaire investor Yuri Milner took the stage for

a Q. and A. at a technology conference in San Francisco. Mr. Milner, whose

holdings have included major stakes in Facebook and Twitter, is known for

expounding on everything from the future of social media to the frontiers of

space travel. But when someone asked a question that had swirled around his

Silicon Valley ascent — Who were his investors? — he did not answer, turning

repeatedly to the moderator with a look of incomprehension.

Now, leaked documents examined by The New York Times offer a partial answer:

Behind Mr. Milner’s investments in Facebook and Twitter were hundreds of millions

of dollars from the Kremlin. Obscured by a maze of offshore shell companies, the

Twitter investment was backed by VTB, a Russian state-controlled bank often

used for politically strategic deals.“

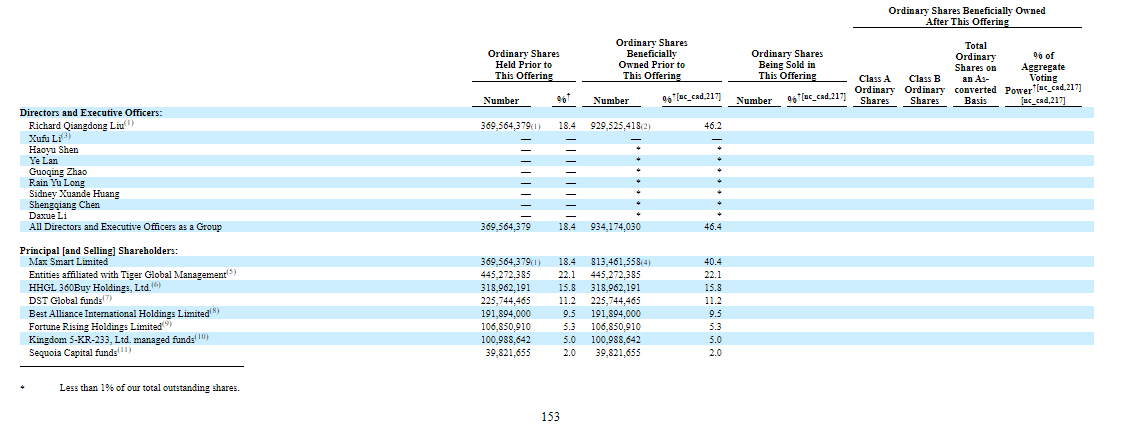

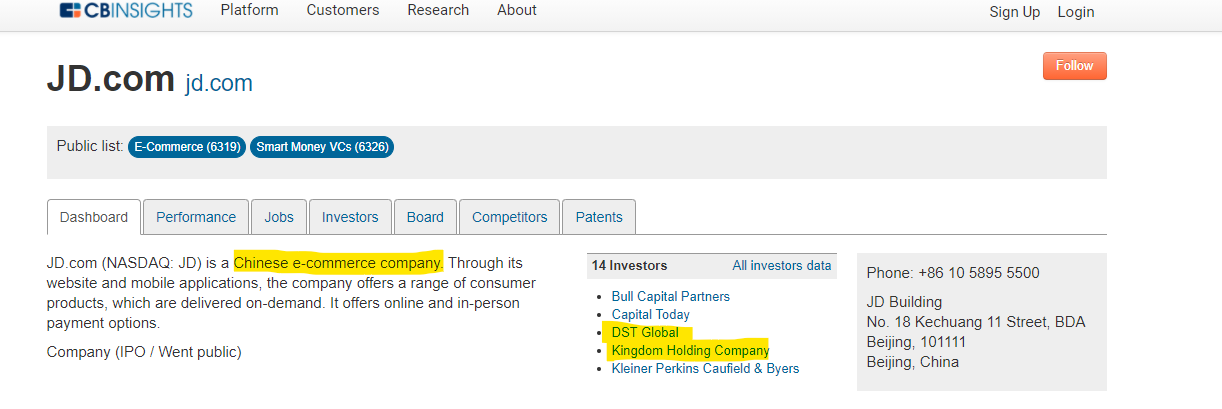

Yuri Milner, the Russian who owns and manages the DST Group, which has invested in China. DST invests in JD.com (so does Kingdom Holding Company).

In an interview with Forbes, Milner gave details on how and why DST invested in Facebook:

“When Marc Andreessen, who was on the board of Facebook at that time, is telling

this story, he says that we had a “large spreadsheet” with data about many social

networks all around the world. We had a lot of supporting evidence that Facebook

would be able monetize the business, while most of the VCs in Silicon Valley did not

have access to this kind of data at that time. So, armed with this “wisdom” and through

an introduction from Goldman Sachs, we managed to convince Mark Zuckerberg that

our money is “smart money”.

But convincing Mark was not enough, it was not easy for both of us to convince our

boards. That is, Facebook’s board to accept an investment from Russia and our board

to make an allocation for an investment outside of our “natural geographical focus”. In

retrospect it really helped that we were not asking for board seats and even assigned

our voting rights to Mark, which sent a strong message that we are not seeking any

influence over Facebook’s operations. We started to invest in Facebook in 2009 and

continued through 2011.

DST’s investment in Facebook got a lot of attention. How much of Facebook did DST

Global ultimately own?

Prior to the IPO, DST Global cumulatively held 5.5% of Facebook.

Is DST still invested in Facebook?

No, we disposed of our stake in 2012-2013.”

Milner stated that DST received investment money from the Russian government:

“Did DST Global take any investment from Russian government organizations?

There was one in the early days. When DST Global invested in Twitter in May 2011, a

bank publicly-listed in the UK, VTB Bank, which is majority owned by the Russian

government, participated in a co-investment. DST divested its Twitter position (including

the VTB Bank co-investment) in May 2014.”

Miner also shared DST was invested in JD.com, a Chinese e-commerce company that Kingdom Holding Company was also a large shareholder of :

Could these foreign investments be related to the claims of censorship and political boas on social media platforms?

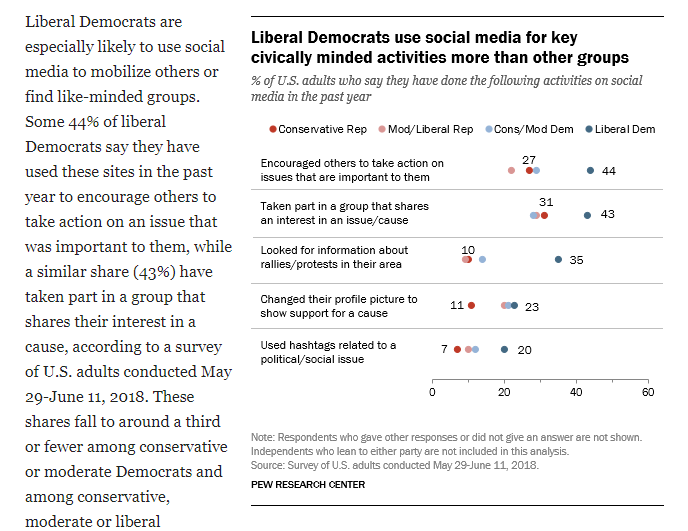

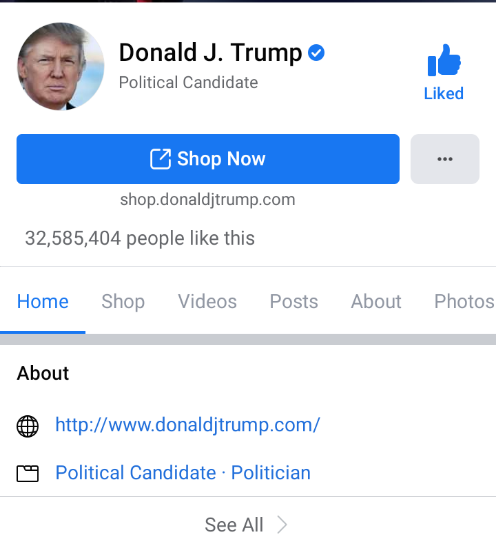

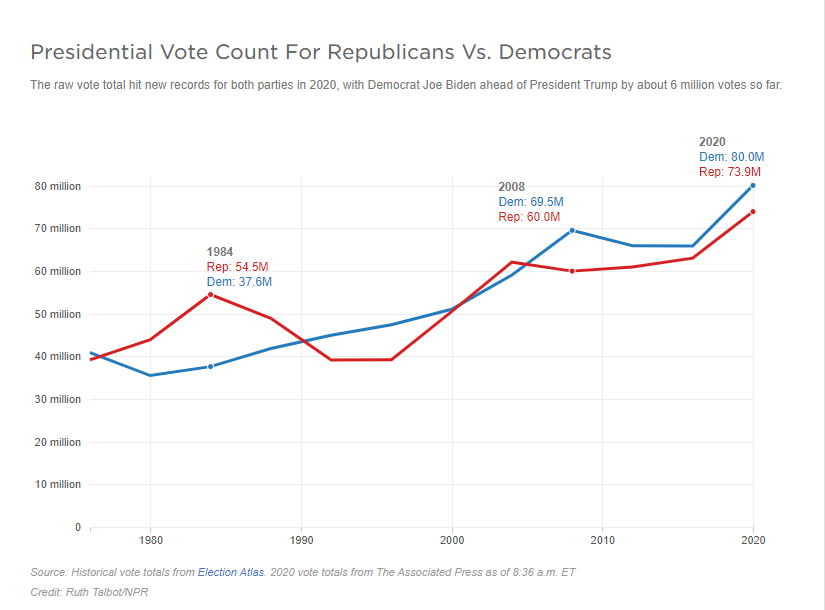

While social media users tend to lean liberal and liberals are far more likely to use social media to share political views, Donald Trump has 88.8 million Twitter followers and 32.5 million Facebook followers. Joe Biden has 20 million Twitter followers and 6.6 million Facebook followers (as of 11/27/20):

It is truly amazing how Biden captured 80 million votes nationally but only has 26.6 million followers on Twitter and Facebook. Trump has 121.3 million followers on those two platforms or 94.7 million more than Biden.